-

Are you looking for an apartment in Atlanta, Georgia. Now may be the time to rent, according to the market. The average rent amount in Atlanta is $1,813, per 2024 data. That’s what you’ll pay for a three-bedroom.

So you should figure on spending around $1,000 on rent in Atlanta for a one-bedroom apartment. But the real question you may now have is “How can I save money on rent in Atlanta?”

Here’s How To Save On Rent In Atlanta

This article is going to show you how to save money on rent in metro Atlanta.

1. Stay Out of North Atlanta

If you want to save hundreds of dollars a month, you’ll do best avoiding apartments in Buckhead, Sandy Springs on up into Alpharetta. Those areas have the highest rents in the metro area.

Instead opt for cities just outside I-285 like Smyrna, East Point or in north DeKalb County’s Doraville and Chamblee.

2. Sign A Longer Lease

Instead of opting for a typical 12-month lease, ask the landlord if they would be interested in locking you up for a longer lease. Be sure to tell them that you’re open to it only with a lower monthly rent.

While it may not be something that an apartment complex goes for, a private landlord of a building or apartment may want the security that a longer lease brings.

3. Go Small

It used to be a time when a larger space was the envy of all your neighbors, but things have changed. Many tenants prefer smaller places now, especially with COVID-19 preventing large indoor gatherings.

4. Barter With Your Landlord

If you’ve got some skills, see if you can barter with your landlord. If you see that they need a service you provide, ask to be compensated with a rent discount.

5. Get A Roommate

If you can live with other people, an easy way to bring your rent costs down is to get a roommate. If none of your friends or family members want to room with you, here are some sites you can find roommates on:

6. Rent In The Winter

Landlords typically offer better deals on rent in the winter, according to ApartmentList.com. In the warmer months are when renters typically decide to move, which inclines landlords to creep their prices higher.

To capitalize on less moving traffic, landlords are apt to drop their rents when it gets cold. The site says December or January are the best times to move.

Last Words

If you’re looking for a place to rent in Atlanta, don’t overpay for your stay.

If you can’t seem to find a place you like to rent due to money reasons, see if you can get a roommate or two.

Another option may be to look into renting a room or long-term Airbnb.

Atlanta has one of the best real estate markets in the country, with affordable housing in every quadrant of the city. Large backyards, manicured parcels and strong neighborhoods with ample dining amenities make it one of the top places for transplants.

Keep up with what’s going on in Atlanta’s real estate scene here.More AtlantaFi:

-

The Atlanta housing market is perennially one of the hottest in the nation and this year is no exception. It’s also very expensive compared to the rest of the Southeast.

As you may know from our Atlanta housing market forecast, this year homeowners may face increased home prices, mirroring a national trend. Average home values in the metro Atlanta area are expected to rise by as much as 6%. However, not all locations will experience this trend; depending on the neighborhood, town, village, and subdivision, some homes may see price drops.

Despite this, there are signs of concern in the U.S. housing market, as noted by Realtor.com:

- The number of homes actively for sale has decreased by 2% compared to last year.

- Unsold homes have decreased by 3.7% compared to last year.

- The median price of homes for sale in October 2023 remained stable compared to the same time last year.

- Homes spent an average of 50 days on the market, which is one day shorter than last year and more than two weeks shorter than before the COVID-19 pandemic.

Why Is the Atlanta Housing Market So High?

There are several reasons why the Atlanta housing market is expensive. Let’s explore a few reasons why:

Low Inventory, High Housing Demand

High demand for housing, driven by factors such as population growth, job opportunities, and low mortgage rates, can lead to higher prices, especially in areas with limited housing supply.

In many parts of the country, there is a shortage of homes for sale, which can drive up prices as buyers compete for available properties.

There’s also the issue of land cost. The cost of land for new construction can be high, particularly in urban areas where space is limited, leading to higher home prices.

Construction Costs

The cost of building materials, labor, and regulatory requirements can make new construction expensive, which can contribute to higher home prices.

Government policies, such as zoning laws and building regulations, can restrict the supply of housing and drive up prices.

Low Interest Rates

When interest rates are low, it can make borrowing for a home more affordable, which can increase demand and lead to higher prices.

Economic factors, such as strong job markets and wage growth, can increase demand for housing and contribute to higher prices.

So what does a prospective homeowner do, knowing that the housing market has basically priced them out? You try to save money.

How To Save Up For a Home

Saving up money for a house requires careful planning and discipline. Here are some steps you can take to save up for your future home:

Set a Savings Goal: Determine how much money you need to save for a down payment and other homebuying costs. This will give you a target to work towards.

- Create a Budget: Review your income and expenses to identify areas where you can cut back and save more money. Allocate a portion of your income specifically for your house savings goal.

Read our guide on how to save up for a home.

Final Word

Real estate is often seen as a safe investment, leading to increased demand from investors, which can drive up prices.

Overall, a combination of factors, including supply and demand dynamics, construction costs, government policies, and economic factors, can contribute to the high cost of housing in the U.S.

Not to mention that the city’s dining scene is the best in the Southeast. Looking for a home? Check out our Real Estate Resource Page.

Keep up with what’s going on in Atlanta’s real estate scene here with our Apartment Guide.

See The Latest Atlanta Real Estate News At AtlantaFi.com.

More Articles From AtlantaFi:

-

David Weekley Homes is set to open its first home community in 2024 with Cherokee County’s Havencroft.

Situated within five miles of downtown Woodstock, the 69 homes offer homebuyers a chance at suburban life and all of its amenities.

So prospective residents can take a look at the new single-family home community, David Weekley Homes will play host to a drive-in tour on March 9 between 10 a.m. and 1 p.m.

Only open to homebuyers who sign up as VIPs, the event will include a chance to meet with the designers, builders, and other team members from David Weekley Homes’ Atlanta Division, preview several available floor plans, learn about the area and community amenities, and more.

Those interested in attending the event and receiving weekly updates about Havencroft can sign up online on the community page at DavidWeekleyHomes.com or call 404-789-3033 to be added to the VIP list.

“We’ve had great success with our VIP drive-in events over the last few years,” said Adam

Cornett, Atlanta Division President for David Weekley Homes. “Being a VIP is an excellent way for homebuyers to get a leg up on the competition amid a highly competitive market.”When Are The New David Weekley Homes Opening In Woodstock?

The community will open to the public in mid-April. Starting prices for homes in Havencroft will be in the High $600s.

Final Word

Atlanta has one of the best real estate markets in the country, with affordable housing in every quadrant of the city. Large backyards, manicured parcels and strong neighborhoods with ample dining amenities make it one of the top places for transplants.

Not to mention that the city’s dining scene is the best in the Southeast. Looking for a home? Check out our Real Estate Resource Page.

Keep up with what’s going on in Atlanta’s real estate scene here with our Apartment Guide.

See The Latest Atlanta Real Estate News At AtlantaFi.com.

More Articles From AtlantaFi:

-

The price of buying a house continues to increase in Atlanta and elsewhere in the state, but one thing that remains affordable is the Georgia clay.

If you’re in the market for some Georgia land, you’re making a wise decision. Real estate prices in rural areas are going up, but are still affordable.

With real estate prices continuing to increase, now’s a good time to buy property. Are you uncertain about the process of buying land in Georgia? Read on….

How Do I Buy Land In Georgia?

In this article, we’ll show you step by step how to buy a plot of land in Georgia.

My family owns several plots of real estate around metro Atlanta and because I’m constantly looking for real estate, I’ve also researched the process thoroughly.

First things first, you need to get pre-approved for a loan.

1. Get Pre-Approved

Getting pre-approved for a loan to buy land is exactly like getting pre-approved for a mortgage. The reason why this initial step is so important is because Realtors will have an incentive to work with and for you.

Once you’re pre-qualified for a loan, the real estate professionals you’re dealing with will take you more seriously because they want your business.

If you apply and are not approved, take these steps to improve your credit fast.

2. Search For Land

It’s time to begin your search for affordable land for sale.

In a large metropolitan area like Atlanta, parcels of land sell at a premium. If you want several acres, you’ll have to expand your search to cities about an hour’s drive from downtown Atlanta.

How Much Does An Acre Of Land Cost In Georgia?

The price of an acre of land in Georgia depends on where it’s located and whether it is improved or unimproved.Last year, the average price per acre in Georgia increased by 11% to $4,550 per acre. Irrigated land averaged $4,060 per acre while the value of non-irrigated land dropped 5% to $3,010 per acre.

If you’re looking for farmland or just some acreage, if you don’t know a Realtor, then you can begin your search online.

Some websites you can look for parcels of land on are:Know The Zoning Laws

Once you’ve found a piece of land you like, familiarize yourself with the local zoning laws.Some areas won’t let you build wooden structures. Other areas won’t let you build with stone. Others won’t allow livestock. Research what’s allowed where you want to live.The typical zoning regulations govern such things as:- Building specifications of the type of buildings allowed.

- Where utility lines must be located.

- Restrictions on accessory buildings, building setbacks from the streets and other boundaries.

- Size and height of buildings.

- Number of rooms in a structure.

In addition to knowing what type of structures are allowed to be built, you’ll need to know land use rules as well.Here are some common land-use zones that could apply to the area you’re interested in:- Agricultural Zoning

- Commercial Zoning

- Combination Zoning

- Historic Zoning

- Industrial Zoning

- Residential Zoning

- Rural Zoning

You may be saying to yourself, “How do I find out about zoning laws?”The best place to start is with the locality’s department of city planning, or similar office. They’ll tell you all you need to know about the zoning laws in that area.3. Compare Your Land Choices

Photo credit: Observer.globe.gov Once you’ve done all your zoning research, it’s time to whittle down your list of land parcels you like and choose one.

Some things you may want to consider are:

- Access: How far is the property from the interstate or major highway?

- Privacy: How close are you to the neighbors and nearby noise?

- Terrain: Are there hundreds of trees, woods or just undeveloped land, dirt or grass?

- Irrigation: Is there a water source nearby? A lake or creek that runs through the property?

All of these things may increase or decrease the value of the land depending on your intentions for it.

In any event, once you’ve made your decision to buy the land, it’s time to put it in writing.4. Make An Offer On The Land

To make a formal offer on a piece of land you’ll need a real estate agent’s Bid Offer form. You can find samples of a Bid Offer form online.

When making an offer, you don’t want to go too high in price. Let your offer be based not on the property’s asking price, but on the amount you’ve been pre-approved for.

Should You Offer Over The Asking Price?

If you offer over the asking price, you’ll have to go back to your lender to make sure you can get financing to cover it.

You’ll also want to know if the appraisal of the land justifies the asking price.

If you make an offer too low, it may not attract the seller because they may get higher offers from others looking to buy the property.

Bottom line: Your offer will have to be higher than the others if you want the land.

Let’s say the seller accepts your offer. What now?5. Sign The Land Sale Contract And Purchase Agreement

Once the offer is accepted, the buyer and seller typically sign a Land Sale Contract / Purchase Agreement.

This is a legal document that solidifies the intentions of both parties to make a real estate transaction.

Here are some terms typically found in a Land Sale Contract / Purchase Agreement:- Price

- Property size, boundaries and description

- Title

- Seller disclosures

Typically, the buyer’s agent will have the purchase agreement written up by a practicing real estate attorney.

The Land Sale and Purchase Agreement becomes binding when all signatures have been obtained.

6. Prepare For Closing

Unlike a home closing, when you’re buying land you don’t have to worry about such things as an inspection and making some demands for last-minute repairs and replacements.

As a buyer, you will typically be expected to provide for anywhere between 2% to 5% of the closing costs. However, depending on other concessions you make, it’s possible that you may not pay any money at all at closing.

One thing you don’t want to skip is a soil test. A soil test also indicates which elements are missing from your soil and how much to add them if you plan on growing fruits, vegetables and other crops.

A soil test will also tell you:

- The pH level in the soil.

- What nutrients and minerals are in the soil such as nitrogen and phosphorus.

You can buy a soil kit from various retailers such as Lowes and Home Depot. You can also order a soil test kit online. Here’s a comprehensive one that I like:

Once you sign all the appropriate documents at closing, the land will be yours! Some real estate lawyers may break out a bottle of Champagne to celebrate, but that’s optional:)

Final Words

Buying a piece of land is a great investment and something that can stay in your family for generations. If you do it right — following all the steps from zoning laws and getting a soil test, etc. — it can be a smooth process.

Because of the many parts involved in buying land, it’s highly advisable that you use the services of a professional real estate agent. A Realtor can walk you through the land-buying process more easily. Also, many of them have the professionals you need already in their network.

More From AtlantaFi.com:

-

The average cost of an Atlanta home has dropped in price over the past six months, which bodes well for homeowners looking to jump into the market. Is the trend expected to continue in the short term? Keep reading.

How Much Does A Home Cost In Atlanta?

The median price for a home in Atlanta sold for $391,685 in December 2023, according to Rocket Homes. That figure is an decrease of 3.2% from last year.

Are Houses Expensive In Atlanta?

The median sales price continues to increase for single-family residential properties in Atlanta as well as other major cities across the country. That means homes in Georgia’s largest city are considered expensive.Here are some more Atlanta housing statistics from Rocket Homes from October 2023, the latest available at this writing:

What Is The Price Of An Atlanta Home By Bedroom Count?

# BEDS# BEDROOMS OCT 2022 OCT 2023 CHANGE 1 Bedroom $259.8K $257.3K -1.0%2 Bedrooms $367.8K $335K -8.9%3 Bedrooms $408.9K $385.8K -5.6%4 Bedrooms $647.5K $575.2K -11.2%5+ Bedrooms $1.2M $925.3K -24.1%See more Atlanta housing statistics at the U.S. Census

Atlanta Housing Market: A Refresher

Atlanta’s leaders in the late 1990s took on the challenge of breaking up the city’s concentrated poverty. This meant that housing projects had to be demolished. That’s exactly what happened.

The large-scale demolition helped spread low-income families throughout metro Atlanta, especially in Clayton and Fayette counties.

Due to the rising costs of inflation, affordable housing began to dwindle in Atlanta. This has increased due to the growth of the Beltline.

Since 2005, more than 2,600 affordable workforce units have been created within walking distance of the Atlanta Beltline. But more must be done.

The city is committed to building 5,600 housing units that are affordable.

Final Word

Purchasing a home may not be as affordable as it used to, but as long as you take the proper steps, including getting an inspection, it can work out.

When it comes to buying land your risk is not as great, but it still takes strategy. On the other hand, you may want to explore the rental market if it makes more dollars and sense for your wallet.

If a home is what you need for you or your family, it may be time to make some money moves to come up with a mortgage.

-

So you want to buy a home. If the home inspection uncovers any issues, you can use this information to negotiate with the seller. You may ask them to make repairs before closing or to lower the price of the home to account for the cost of repairs.

In this article, we’ll cover what you need to know about getting a home inspection and why it’s important.

- How Much Does a Home Inspection Cost?

- How Long Does a Home Inspection Take?

- Why Is a Home Inspection So Important?

- Top Home Inspectors In Atlanta

How Much Does a Home Inspection Cost?

The cost of a home inspection can vary depending on several factors, including the size and location of the home, as well as the complexity of the inspection. On average, a home inspection may cost between $300 and $500 for a typical single-family home. However, prices can range higher or lower based on these factors.

It’s important to note that while cost is a consideration, the quality and thoroughness of the inspection are also crucial. It’s generally recommended to hire a qualified and experienced home inspector who will provide a comprehensive evaluation of the property, even if it means paying a slightly higher fee.

When budgeting for a home inspection, it’s also important to consider the potential savings or negotiation leverage that a thorough inspection can provide. Uncovering major issues with the property can allow you to negotiate repairs or a lower purchase price with the seller, potentially saving you money in the long run.

How Long Does a Home Inspection Take?

The amount of time a home inspection takes depend on several factors, including the size and condition of the home, as well as the thoroughness of the inspection. On average, a typical home inspection for a single-family home can take anywhere from 2 to 4 hours to complete.

However, larger or more complex homes may require more time to inspect thoroughly, while smaller or simpler homes may take less time. Additionally, if the inspector identifies significant issues during the inspection, they may need additional time to assess the severity of the problems or to gather more information.

Why Is a Home Inspection So Important?

Getting a home inspection before buying a home is important for several reasons:

Identifying Potential Problems

A home inspection can uncover any issues with the property that may not be visible to the naked eye. This can include structural problems, safety hazards, or issues with the electrical, plumbing, or HVAC systems.

The inspector should assess the insulation levels and ventilation in the attic and crawl spaces to ensure energy efficiency and prevent moisture problems.

A good home inspector will also look for any safety hazards, such as exposed wiring, trip hazards, or other issues that could pose a risk to occupants.

Finding Out the True Condition of the Property

A home inspection provides a detailed report on the condition of the property, giving you a clear understanding of what you’re buying and any repairs or maintenance that may be needed.

Budgeting for Future Maintenance

Even if the home is in good condition, the inspection report can help you plan for future maintenance and repairs, allowing you to budget accordingly.

Top Home Inspectors In Atlanta

Although this is a partial list, we’ve really heard great things about these Atlanta home inspectors.

- US Inspect

- Atlanta Home Inspector

- Castle Home Inspections

- Discovery Inspections

- Inspect-All Services

Final Word

It’s important to choose a qualified and experienced home inspector who will take the time needed to conduct a thorough evaluation of the property.

Overall, a home inspection is an important part of the home buying process that can help you make a more informed decision and avoid potential issues down the road.

Atlanta has one of the best real estate markets in the country, with affordable housing in every quadrant of the city. Large backyards, manicured parcels and strong neighborhoods with ample dining amenities make it one of the top places for transplants.

Not to mention that the city’s dining scene is the best in the Southeast. Looking for a home? Check out our Real Estate Resource Page.

Keep up with what’s going on in Atlanta’s real estate scene here with our Apartment Guide.

See The Latest Atlanta Real Estate News At AtlantaFi.com.

More Articles From AtlantaFi:

-

One thing you’re going to need if you’re trying to get a house is a mortgage. And to get a mortgage, you need to be pre-approved.

At this point, you should have saved up all the money you can for a down payment.

If you’re already pre-approved for a home loan, it signals to the loan officer, real estate agent and seller that you’re ready to purchase — and not playing around.

What Is The Best Way To Get Pre-Approved For A Mortgage?

The best way to get pre-approved for a mortgage is to have all your paperwork in order, but it includes more than that.

Your credit score is of paramount importance to a mortgage lender, but more on that later.

Follow These 3 Steps To Get Approved For A Mortgage

This article will go over the steps you need to get pre-approved so that you can get a mortgage.

First, let’s go over what a mortgage pre-approval is and how it works for you.

A mortgage pre-approval is a preliminary step to buying a home. It involves an initial offer from a lender to loan you a certain amount of money so that you can buy a home.

What Is A Mortgage Pre-Approval And How Does It Work?

The amount of money that the lender pre-approves is based on their evaluation of your three things:

- Your Creditworthiness

- Your Finances

- Your Job Outlook

A mortgage pre-approval will require that you hand over a lot of your personal information, including your Social Security number for a credit check and more.

1. Get Your Free Credit Report

The first step you need to do is get a free copy of your credit report. You can do that by going to AnnualCreditReport.com.

AnnualCreditReport.com is a government-backed website that shows you your credit reports from the Big 3 credit Bureaus: Equifax, Experian and TransUnion.

2. Shop Around for a Lender

Different lenders offer different mortgage products and may have different criteria for pre-approval. It’s a good idea to shop around and compare offers from multiple lenders to find the best terms for your situation

3. Get Your Credit Scores

You’ll also want to find out what your credit scores are from the Big 3 credit bureaus. If your credit scores are low with a particular credit-reporting agency or with all of them, you should try to improve them.

Here’s how to improve your credit score easily.

What Credit Score Is Needed For A Home Loan In Georgia?

In Georgia, as well as elsewhere, you’re going to need a credit score on the high end to qualify for a home loan.

According to Credit Karma, which uses the Average VantageScore 3.0 model, the national qualifying average credit score is 717. In Georgia, you’ll need a score around 700 to purchase a home.

f your credit score is lower than you’d like, take steps to improve it before applying for a mortgage. This can include paying down existing debts, making all your payments on time, and avoiding opening new lines of credit.

4. Have Your Financial Paperwork In Order

Before you get pre-approved, you’ll need some documents for verification purposes. These include:

- Social Security number

- W-2 or 1099 tax form

- Paycheck Stub

If you plan to have someone on the loan with you — perhaps a spouse or significant other — they will have to submit some personal information as well.

To apply for a mortgage pre-approval, you’ll need to provide various documents, including proof of income (such as pay stubs or tax returns), proof of assets (such as bank statements), and information about your debts (such as credit card balances and loan payments).

5. Get Pre-Approved!

Once you gather all of that financial information, you can submit it for mortgage pre-approval to your lender of choice.

Here’s a pro tip you might want to consider: Always try to get pre-approved with more than one lender. This increases your chances of getting pre-qualified exponentially.

Once you’ve chosen a lender, you can apply for pre-approval either online, over the phone, or in person. The lender will review your financial information and credit history to determine how much they’re willing to lend you and at what interest rate.

If you meet the lender’s criteria, you’ll receive a pre-approval letter stating the maximum amount you can borrow and the terms of the loan. This letter can be used to show sellers that you’re a serious buyer when making an offer on a home.

Once you’re approved, you can start to search for your dream home in Atlanta or any city you want to live in.

Conclusion

Your mortgage pre-approval is just that, a pre-approval. That means it still might not go through due to financial issues that come up.

Let’s say you lose your job during the pre-approval process. Then it’s a good chance, the lender will back out and your mortgage won’t be approved.

That’s why it’s a good idea to dispute any issues on your credit report or any other issues that come up. Here’s how to dispute your credit report.

Atlanta has a lot of inspirational people and AtlantaFi.com is going to introduce you to many of them as well as cool places to go, great restaurants and other ATL happenings.

Got an event or know of something opening in and around Atlanta? Holla: CJ@AtlantaFi.com. See what’s poppin’ in the ATL! Subscribe to our news alerts here, follow us on Twitter and like us on Facebook.

-

Buying a house in 2024 is a bit more challenging than in recent years, but according to real estate experts, the market is set to improve.

In this article, we’ll go over how to buy a house in Atlanta.

How Much Do You Need To Make To Buy A House In Atlanta?

According to recent data, the median home price in Atlanta is around $350,000. However, home prices can vary widely depending on the neighborhood and type of property you’re interested. If you’re a novice homeowner (or not), it’s best to do your homework on the front end.

Read our guide on how much home to afford.

Atlanta’s real estate market features the best of the Southeast, which means you’ll likely get plenty of land, but the prices continue to encroach upon what you’d find in the Northeast.

Thinking about buying a home this year? Here are a few factors you might want to consider:

Get Your Money Right

There’s nothing like falling in love with a home you know you can’t afford. Places like Buckhead, Dunwoody, Fayetteville and Locus Grove have big homes but so are the mortgages.

Before you start looking for a house, it’s important to understand your financial situation. This includes knowing your credit score, saving for a down payment, and getting pre-approved for a mortgage.

Read our guide on how to get pre-approved for a mortgage.

Understand the Atlanta Market

The Atlanta real estate market is a volatile one in that it can trend in different directions throughout the year. It’s your job to stay on top of the changes.

Real estate markets can vary widely depending on location and economic conditions. Research the housing market in the area where you want to buy to understand pricing trends, inventory levels, and competition.

Make a Wish List

It’s important to get what you want out of your home. Some people need privacy; others need entertainment space.

Make a list of what you’re looking for in a home, including must-haves and nice-to-haves. This will help you narrow down your search and focus on properties that meet your criteria.

Hire a Real Estate Agent

A good real estate agent can be invaluable in helping you find the right home, negotiate a fair price, and navigate the buying process.

The best real estate companies take their time with you and provide excellent customer service all while making you feel heard and seen.

Get a Home Inspection

Once you’ve found a home you like, it’s important to have it inspected by a professional. This can uncover any potential issues with the property that could affect its value or your decision to buy.

A home inspection can provide peace of mind knowing that you’re making an informed decision about the condition of the property.

Overall, a home inspection is an important part of the home buying process that can help you make a more informed decision and avoid potential issues down the road.

Make an Offer

When you’re ready to make an offer on a home, your real estate agent can help you determine a fair price based on comparable sales in the area and other factors. They can also guide you through the negotiation process.

Secure Financing

Once your offer has been accepted, you’ll need to finalize your mortgage. This involves providing documentation to your lender, getting an appraisal, and completing the underwriting process.

Close on the House

The final step in buying a house is the closing process, where all the necessary paperwork is signed, and the ownership of the property is transferred to you. This usually involves paying closing costs and fees, so be prepared for these expenses.

Final Thought

Buying a home is a wonderful experience when you think about the dream of homeownership and its many benefits.

The process of buying a house can vary depending on your individual circumstances, so it’s important to do your research and work with professionals who can help guide you through the process.

Atlanta has one of the best real estate markets in the country, with affordable housing in every quadrant of the city. Large backyards, manicured parcels and strong neighborhoods with ample dining amenities make it one of the top places for transplants.

Not to mention that the city’s dining scene is the best in the Southeast. Looking for a home? Check out our Real Estate Resource Page.

Keep up with what’s going on in Atlanta’s real estate scene here with our Apartment Guide.

-

Atlanta / Business / Real Estate7 Min Read

The Atlanta real estate market in 2024 is shaping up to be more difficult than previous years as home affordability continues to be a theme. As interest rates climb, the real estate industry as a whole has responded by contracting.

That means it’s getting more difficult to buy land in Georgia as property values rise across Georgia of late, but experts are expecting things to cool off at some point.

According to Realtor.com, existing home sales will rise, but not as much as in recent years past. Here’s the forecast:

Metro Atlanta Real Estate Outlook: 2024

Two years ago, Atlanta had perhaps the hottest real estate market, and it’s still the leading housing market to watch, although the reasons why are not as plentiful as they have been in years past.

Will 2024 Be a Better Time To Buy a Home?

The year 2024 will be one in which homeowners face increased prices for homes. Average home values in the metro Atlanta area will mimic much of the nation, which is forecast to see as much as 6% hikes.

Not every location will have home values that increase though. Depending on the neighborhood, town, village and subdivision, some homes see drops in price.

Still, some ominous signs are starting to appear in the U.S. housing market based on national trends, according to Realtor.com.

- Homes actively for sale have fallen 2% compared to last year.

- Unsold homes have fallen 3.7% compared to last year.

- The median price of homes for sale in October 2023 remained stable compared to the same time last year.

- Homes spent 50 days on the market – one day shorter than last year and more than two weeks shorter than before the COVID-19 pandemic.

Is Atlanta’s Housing Market Overpriced?

Atlanta’s housing market has been one of the most overpriced in the Southeast. According to a study from Florida Atlantic University, metro Atlanta was the second most–overpriced housing market in 2023, only behind Coral Springs, Florida.

If you live in Atlanta, you’ll be feeling some pain in your wallet, and you might be paying more than you should be. According to data from Florida Atlantic University, Atlanta has the most overpriced housing market in the United States.May 9, 2023

Is 2024 a Good Time To Buy a Home In Georgia?

In September 2023, homes in Georgia sold for 98.3% of their listed price. This means that sellers are willing to negotiate and offer discounts. The GDP of Georgia grew by 5.8% in 2022. This shows that real estate property investment is a beneficial option for potential home-buyers.

Will Prices Go Up Or Down In 2024 In Atlanta?

Prices in Atlanta, Georgia are expected to grow on average of 6% based on Zillow data. That represents a 1% increase compared to the 4% annual growth experienced before the COVID-19 pandemic.

There will be a glut of inventory of homes for sale in the metro area, and they will likely take longer to get offers and sales. How to afford a home will also be more of a challenge this year as economic factors loom, expert data says.

As home shoppers are expected to pre-qualify for a mortgage, there will be more homes for sale, homes will likely take longer to sell, and buyers will not face the extreme competition that was commonplace over the past few year.

If you have a home for rent inside the Perimeter, finding a tenant shouldn’t be a problem as favorable rents will drive strong demand from the north side of the city to the southern end.

Will House Prices Be Cheaper This Year?

With so many people moving to Atlanta annually, rather than become cheaper, leading real estate market experts expect home prices to increase slower than they have over the past two years.

Atlanta, one of the fast-growing cities when it comes to home sales, is not unlike other large Southern cities in that it is expected to continue to be a red-hot market. That means a dip in housing prices is unlikely.

One of the main factors that will influence home prices is the economic landscape of the United States. Namely, the incremental movements by the Federal Reserve to get inflation in check.

While interest rates are ticking upward, the chance that a full-blown recession takes hold in 2023 can’t be entirely discounted. But what such a move will no doubt do is slow down the mortgage industry.

Rising mortgage rates are expected to continue to shed competition among people looking to buy a home. While a buyers market is a possibility in some areas, for metro Atlanta, it is anticipated that real estate prices will hold up just enough that such a market won’t firmly take hold.

Home shoppers priced out of the market will likely create pressures on the rent market, boosting prices once again.

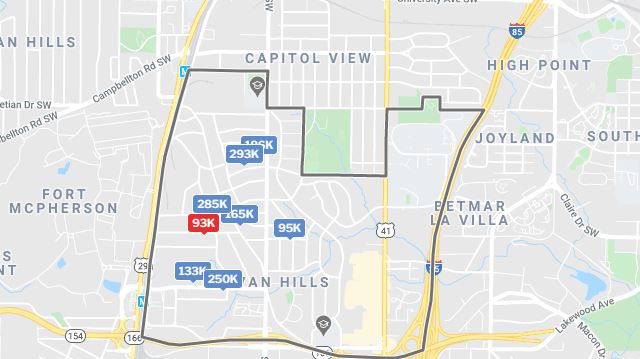

Home Prices On Atlanta’s Southside: Up

One of the most dramatic increases in home prices is happening on Atlanta’s southside, below Interstate 20. Take for instance the Sylvan Hills neighborhood.

Sylvan Hills

The average home prices in Sylvan Hills is $232,000, according to RedFin.

The area is only four miles from downtown Atlanta and is a historically economically depressed area, but not anymore. Gentrification is happening there and in similar areas on a large scale.

Like Capitol View just north, Sylvan Hills homes sell for about 4% below list price and pending sales last around 62 days.

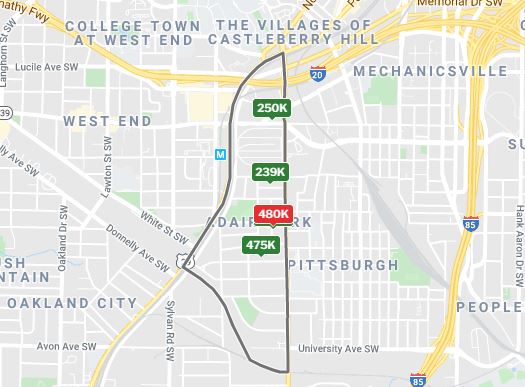

Adair Park

Adair Park over the past five years has had some of the hottest real estate parcels in Atlanta.

Bordered by the West End on one side and the Pittsburgh community on the other, Adair Park has benefited from its close proximity to downtown Atlanta as well as Hartsfield-Jackson Airport.

The average home price in Adair Park is around $240,000, according to RedFin. Homes there sell for about 4% below list price and sales are pending around 41 days.

Atlanta Beltline

But we can’t talk about Atlanta housing trends and real estate outlook with the “B” word: Beltline.

Nothing has shaped Atlanta real estate prices more than the Atlanta Beltline project, which continues to finish a 22-mile loop around the city’s best neighborhoods.

Redevelopment, such as the opening of Krog Street Market and other projects have skewed home prices in the city’s interior in many cases leading to double digit growth.

As more projects see the light of day, we can only predict that home values around the Eastside, Westside and Southside Trails will continue to rise.

Read more: This People Are Having Too Much Fun On The Atlanta Beltline

Overall, many people, especially those relocating to Atlanta, continue to opt for the suburbs. They also are choosing areas farther out, including Dawsonville, Cumming, Stockbridge and Cartersville.

The Georgia real estate market is up 20% over the decade, with most of that confined to the metro Atlanta area.

Here Is How The Georgia Real Estate Market Has Grown From 2010-2018

- 2010 -4.41%

- 2011 -7.33%

- 2012 -1.75%

- 2013 5.14%

- 2014 6.59%

- 2015 6.37%

- 2016 6.69%

- 2017 7.14%

- 2018 8.23%

The Georgia Home Price Index is on an unprecedented streak, having risen for the last 26 consecutive quarters.

Final Word

Homeownership is becoming attainable for more Americans than ever before. And especially is that the case in Georgia.

The Peach State’s largest city has one of the best real estate markets in the country, with affordable housing in every quadrant of the city. Large backyards, manicured parcels and strong neighborhoods with ample dining amenities make it one of the top places for transplants.

Not to mention that the city’s dining scene is the best in the Southeast. Looking for a home? Check out our Real Estate Resource Page.

Keep up with what’s going on in Atlanta’s real estate scene here with our Apartment Guide.

More Articles From AtlantaFi:

-

If you buy an older house, one of the expenses you may eventually face is a bathroom remodel. That means you’re going to have to have some money set aside.

How Much Is a Bathroom Remodel?

The cost of remodeling a bathroom can vary widely depending on several factors, including the scope of the project, the quality of materials, your location, and whether you’re doing the work yourself or hiring professionals.

On average, bathroom remodeling costs in the United States can range from a few thousand dollars to tens of thousands of dollars or more. Here are some cost considerations:

A few months ago, we decided to remodel a bathroom in our Georgia home. I knew that I wanted to take an affordable option rather than go all out on the bathroom renovation.

In this article, I’m going to show you all the steps to take to remodel a bathroom for less.

How To Remodel a Bathroom

Before you get started, you need to consider some things:

Scope of the Project

The extent of your bathroom remodel will have the most significant impact on the cost. A minor cosmetic update, such as replacing fixtures and giving the bathroom a fresh coat of paint, will cost significantly less than a full-scale renovation that involves moving plumbing, replacing all fixtures, and changing the layout.

I knew that I wanted to spend around $5,000 on a bathroom remodel. That automatically meant that whoever I hired needed to be a small business owner and not a big conglomerate that hires a bunch of people.

Design and Planning

If you hire a designer or architect to help plan your bathroom remodel, their fees will be an additional cost.

If you’re married, there is a good chance that your spouse may choose to take on this part of the project. Not only will it save you money (like it did in my case) but it can make for a happy home:)

Materials and Fixtures

You also need to decide if you’re going to buy high-end fixtures from boutique vendors or if you’re going to visit your local Home Depot and Lowe’s for the run-of-the-mill products.

The quality and type of materials and fixtures you choose can greatly affect the cost. High-end materials, like natural stone or designer fixtures, will increase the budget.

Labor Costs

Finding affordable contractors has always been a sport in Atlanta, but it’s a necessary endeavor if you want to save more.

If you hire professionals, labor costs will be a substantial portion of your budget. Labor costs can vary by location and the complexity of the work.

Each of these resources has their detractors, but I found a contractor by looking at the following places:

- Angi

- Google Reviews

- Craigslist

Read our guide on hiring a reputable contractor.

Permits and Inspections

As a rule of thumb, in most municipalities, if you tear down an existing wall, you’ll need a permit to get the work done. This is not only a safety protection, but it ensures that local building codes are enforced.

Depending on your local building codes and the extent of the remodel, you may need permits and inspections, which can add to the overall cost.

Demolition and Disposal

One of the most unexpected costs associated with a remodel is demolition and disposal of the trash. Many contractors will build the expenses of trash removal into their fee, but – as I found out – not all of them.

To save money, I chose to physically remove the trash from my home myself, and it was a major headache!

Removing old fixtures, tiles, and other materials can be a labor-intensive process and may require a dumpster for disposal.

Plumbing and Electrical Work

If you need to move plumbing or electrical connections, it will add to the cost of the project as well.

When you hire a contractor for a job that includes skills of the major trades, it is their responsibility to bring tradesmen in on the job to get the work completed.

Unexpected Issues

No matter how well you plan, there is always the possibility of unexpected and unforeseen problems with a remodel.

In my case, an old corroded plumbing pipe added some significant expenses and time to the project. You’ll have to plan for this whenever doing any kind of remodeling project.

Final Word

Remodeling a bathroom or any room in your house is a major task. There are so many pieces you’re going to have to put together to avoid crazy stress or debt problems.

And you also need to hire a reliable contractor that knows how to get the job done in the timeframe you’ve established.