A good credit score is essential to keeping the purchasing power to buy the things you need and want.

A lot of people no less than zero about their credit scores, so i”m going to break down all you need to know about them, including where to get them and what’s a good credit score range.

What Is A Credit Score?

A credit score is a three-digit number assigned to consumers who borrow money. The higher the score, the lower your credit risk.

If you’re under 18, you may not have a credit score yet.

As soon as you turn 18, you may notice a bunch of credit card offers in the mail. That’s because by law you’re fair game to be solicited to get a credit card.

How To Get Your Credit Score

Let’s say you apply for that credit card and get it. Then, you’ll be assigned a credit score. It will be used by lenders to access your credit risk.

Here’s How To Get Your Credit Score:

Every year, you have the right to request one free copy of your credit report from three major credit reporting agencies – Equifax, Experian, and TransUnion.

You can can request your free credit report online at AnnualCreditReport.com or by calling toll-free 1-877-322-8228.

If you have any discrepancies on your credit report, you can dispute it.

When you get your credit report, here’s what you should do:

- Go over your credit reports with a fine tooth comb

- Make sure you know which open accounts you have

- Make sure you know which closed accounts you have

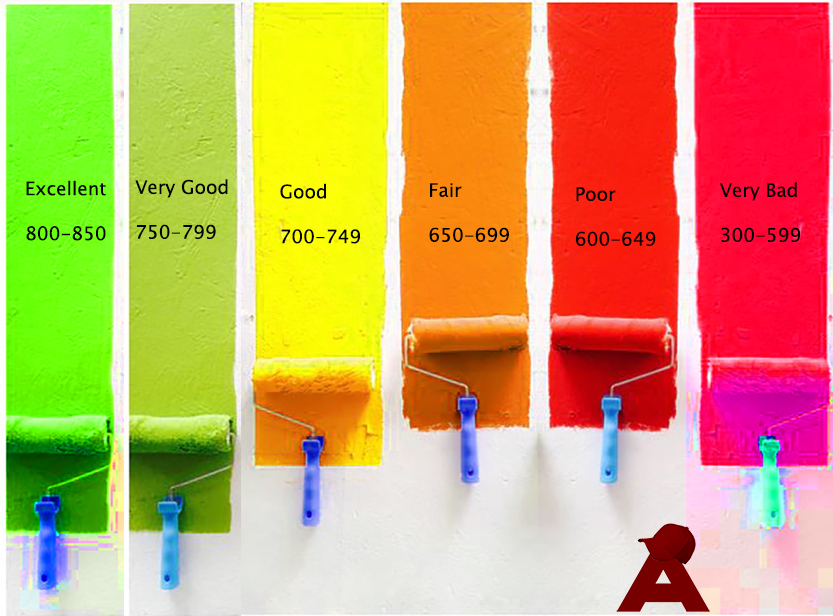

Credit Score Ranges: What They Mean

Once you receive your credit report, you’ll see scores ranging from 300 to 850. Here are the credit score ranges for a consumer:

- Excellent Credit: 850-800

- Very Good Credit: 799-750

- Good Credit: 749-700

- Fair Credit: 699-650

- Bad Credit: 649-600

- Poor Credit: 599-300

What Is A Good Credit Score Range?

A good credit score range is one that is between 700 to 749. The credit scores are determined by he Fair Isaac Corporation (FICO), which created the scores that lenders use to issue credit.

What Is A Good Credit Score To Buy A House?

If you have fair credit, you can still get credit, it just will be at a higher interest rate. Lenders will generally let you qualify for a mortgage with a credit score above 650.

What Is A Good Credit Score To Buy A Car?

If you want to buy a car, you can typically qualify with a credit score around 650, which is again in the fair range.

The truth is that there’s no uniform, agreed-upon minimum that lenders abide by. There’s just so many other factors at play, like how much your downpayment is.